Created

:2023.11.15

Our swap point comparison tool allows you to check the swaps of long and short positions for all instruments offered by brokers. Data is calculated on a daily, weekly, or monthly basis, in points or currency (JPY, USD, or EUR). See below for how to use this tool.

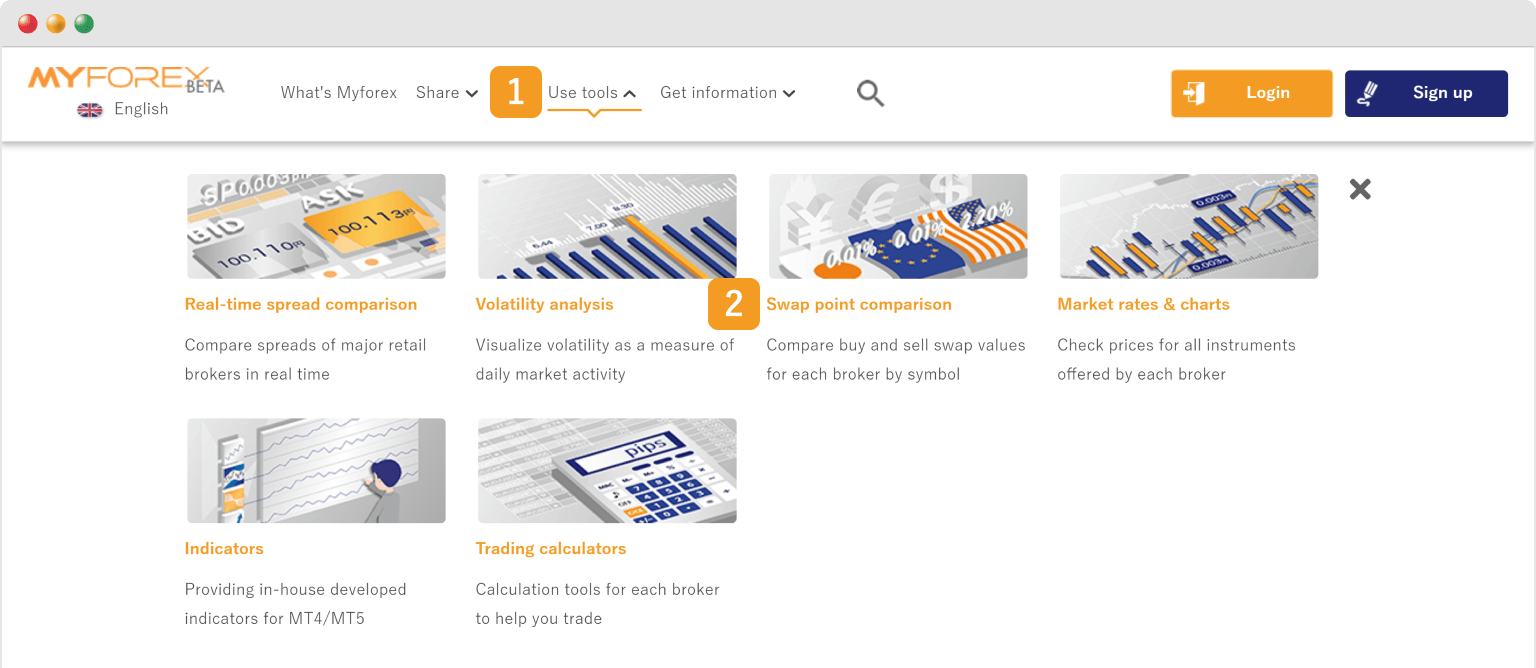

Click (1) "Use tools" shown at the top of Myforex website > (2) "Swap point comparison".

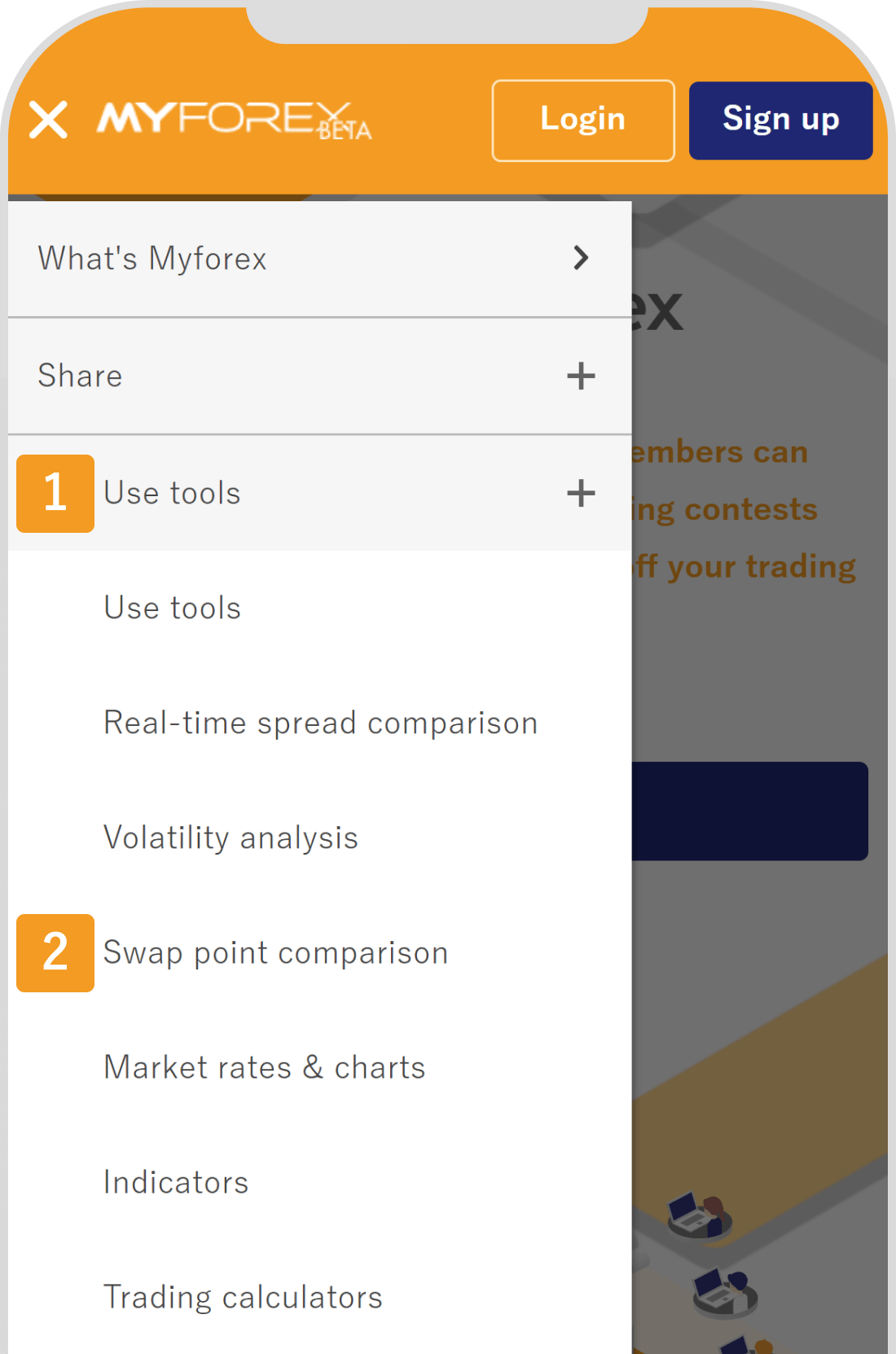

From three lines at the top left of Myforex website, tap (1) "Use tools" > (2) "Swap point comparison".

A swap is a difference in the interest rates of the currencies to be traded. For example, the USDJPY swap is based on the difference in interest rates of USD and JPY. Swaps are either paid or earned. Typically, you will be charged when you hold a short (sell) position in the currency with the higher interest rate, and credited when you hold a long (buy) position in the currency with the higher interest rate.

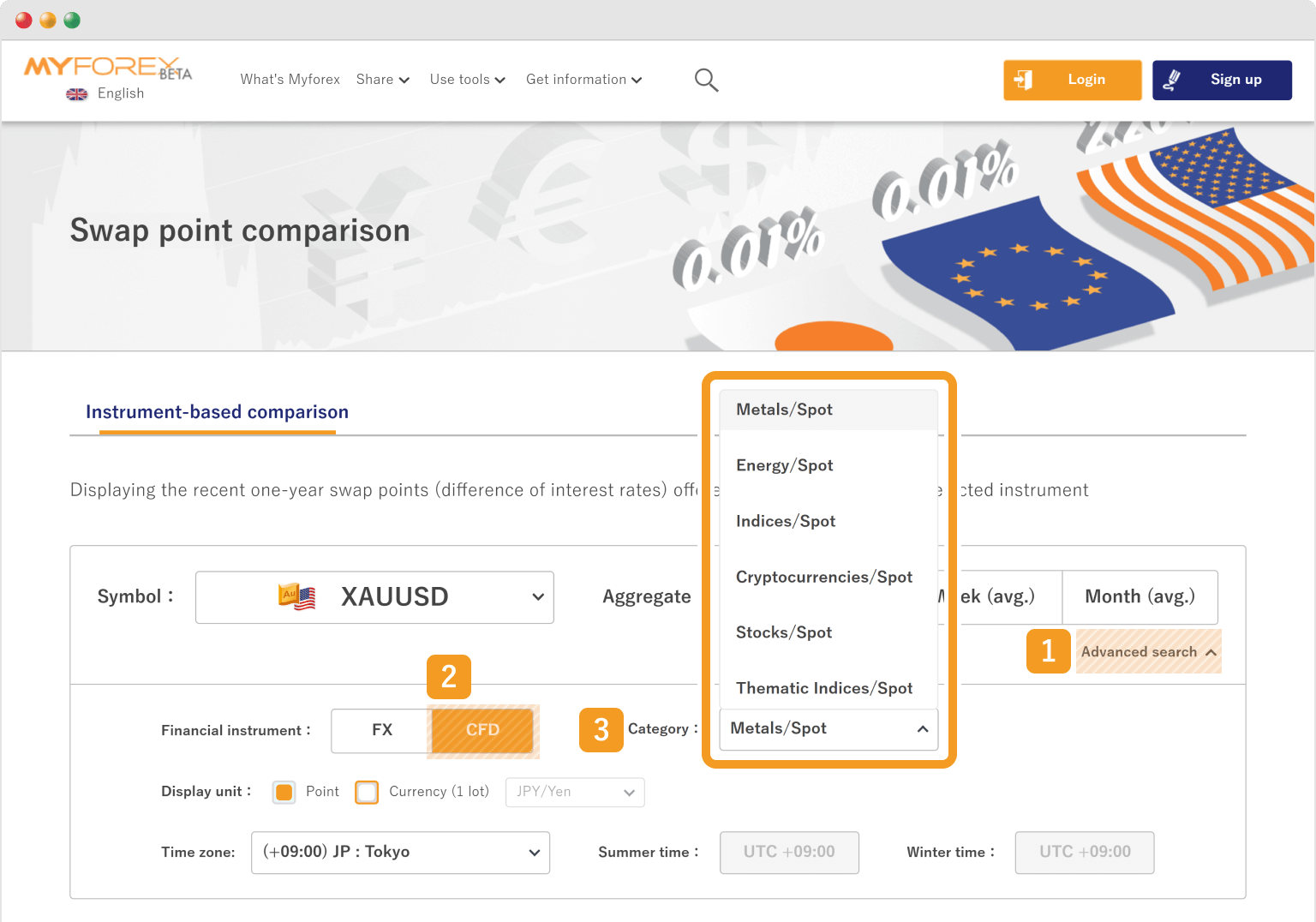

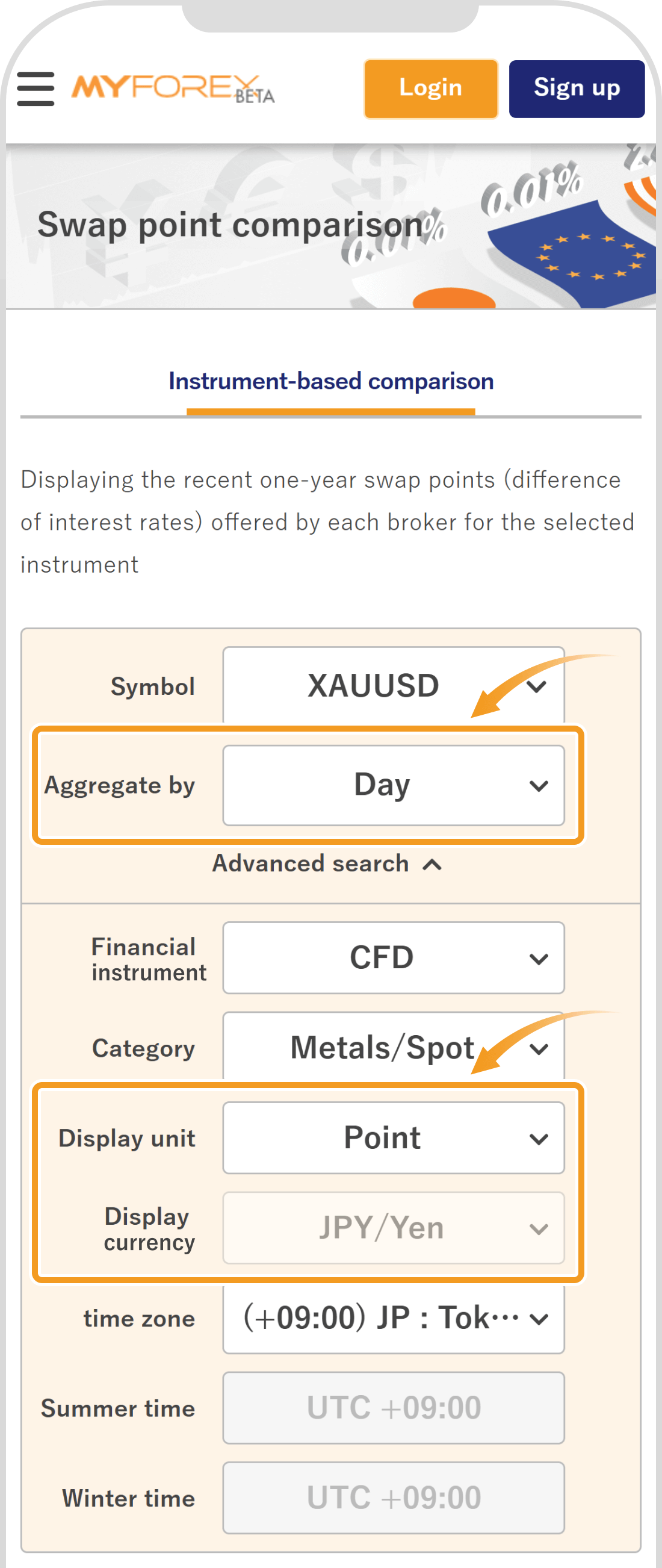

Choose a symbol. For CFDs, click (1) Advanced search and (2) CFD as a financial instrument. Choose a (3) category to show its list of products in the Symbol section.

Choose a symbol. For CFDs, tap (1) Advanced search and (2) CFD as a financial instrument. Choose a (3) category to show its list of products in the Symbol section.

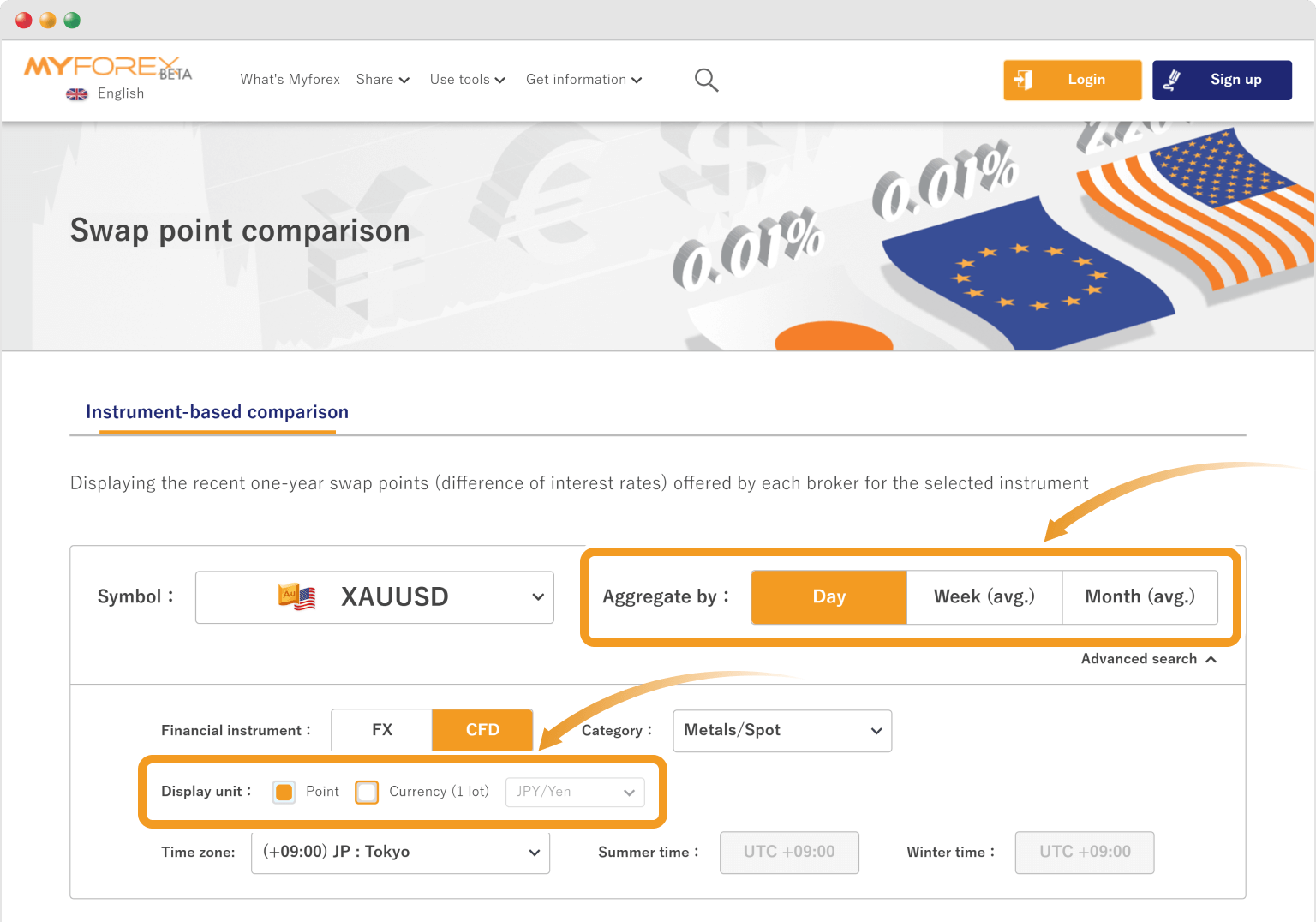

Choose an aggregation period from day, week, or month. Choose a data unit. For Currency, choose a specific currency as well.

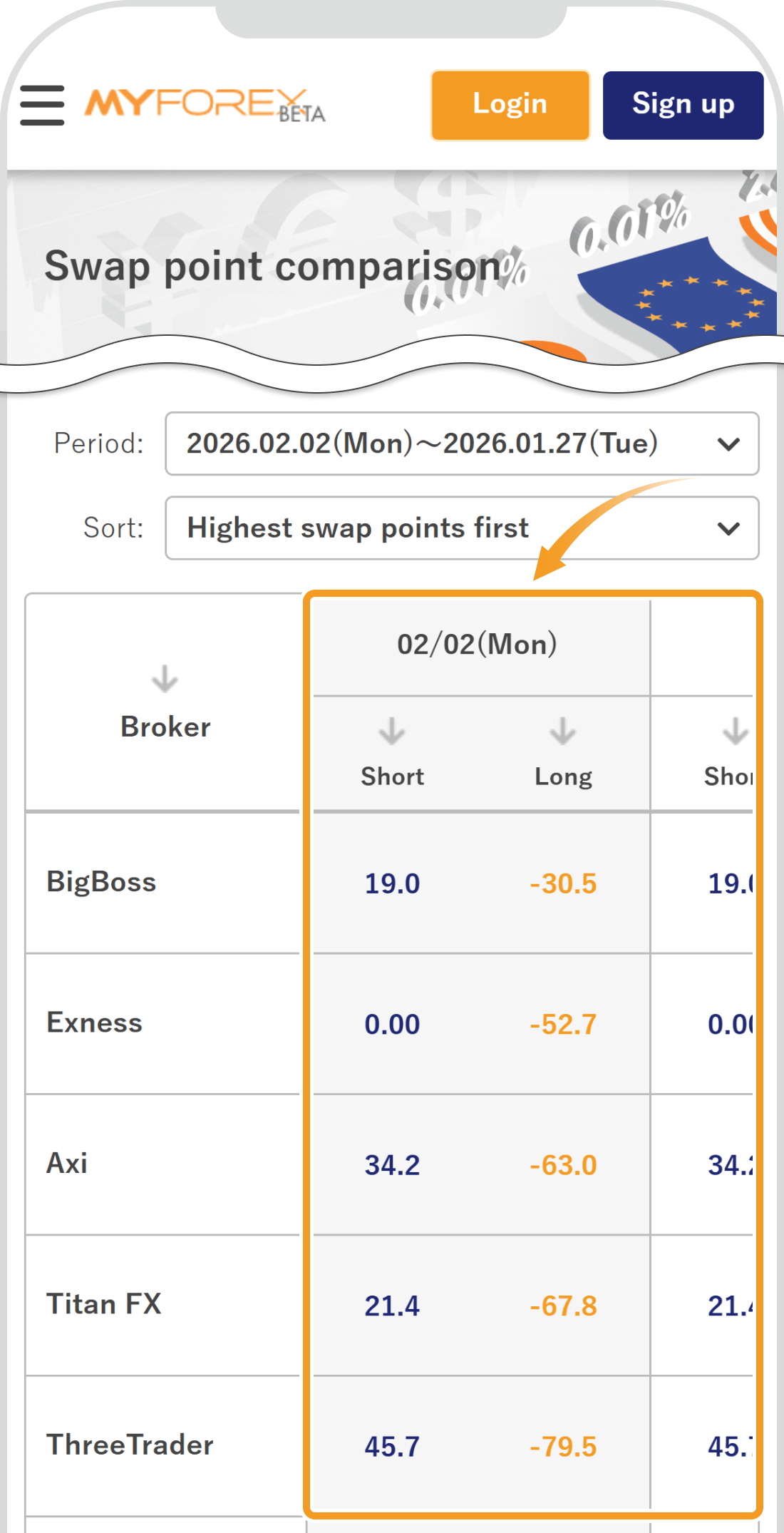

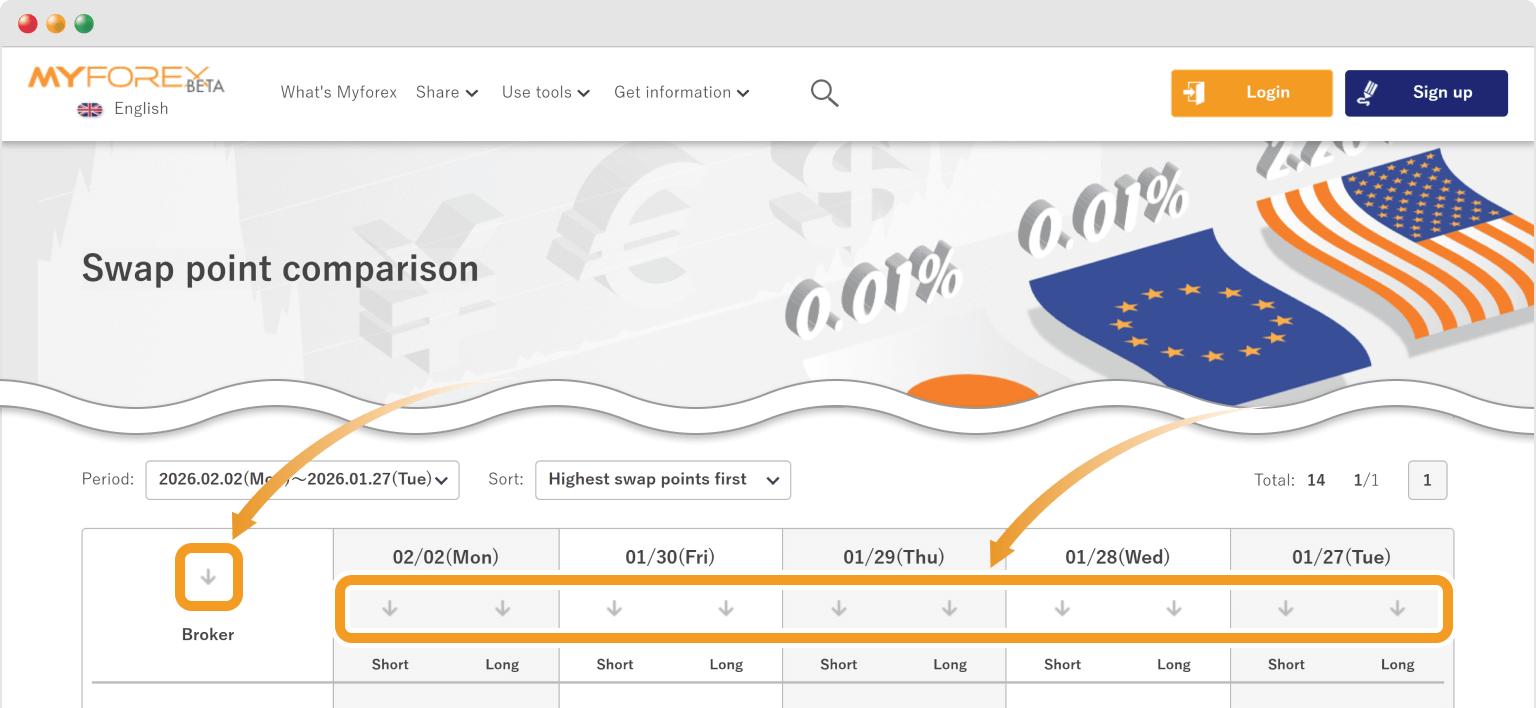

Choose a period and sorting order.

Swaps are displayed in the selected order for the specified period.

Click the Broker, Short, or Long arrows to sort the data in ascending/descending order.

Tap the Broker, Short, or Long arrows to sort the data in ascending/descending order.

A short is a transaction in which the trader holds a sell position with the expectation that the rate will fall in the future. A long is a transaction in which the trader holds a buy position with the expectation that the rate will rise in the future.

![]()

Created

:2023.11.15

![]()

Last updated

:2026.02.13

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article

We hope you find this article useful. Any comments or suggestions will be greatly appreciated.

We are also looking for writers with extensive experience in forex and crypto to join us.

Please contact us at support@myforex.com

Disclaimer:

All information and content provided on this website is provided for informational purposes only and is not intended to solicit any investment. Although all efforts are made in order to ensure that the information is correct, no guarantee is provided for the accuracy of any content on this website. Any decision made shall be the responsibility of the investor and Myforex does not take any responsibility whatsoever regarding the use of any information provided herein.

The content provided on this website belongs to Myforex and, where stated, the relevant licensors. All rights are reserved by Myforex and the relevant licensors, and no content of this website, whether in full or in part, shall be copied or displayed elsewhere without the explicit written permission of the relevant copyright holder. If you wish to use any part of the content provided on this website, please ensure that you contact Myforex.